While you might not consider ethics in AI a primary concern for your business, consider…

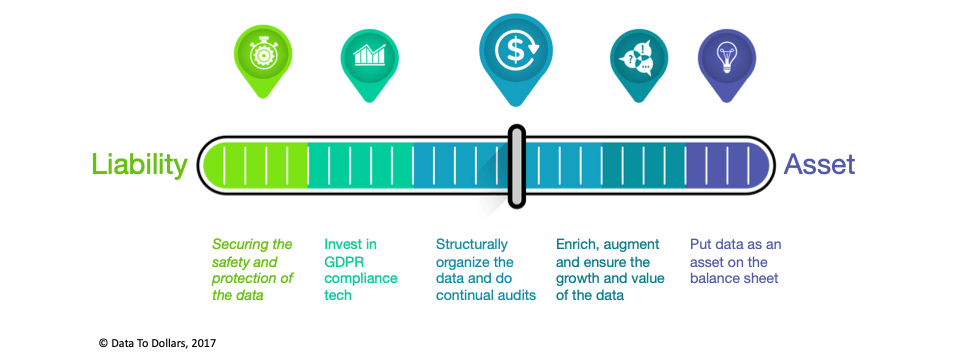

Data: A liability, an investment or an asset?

What and how to treat your data as a corporate asset, as the foundation for future cashflows…

What do you really think of data? At the point of sounding as a broken record, we have all heard the mantra ‘data is the new oil’. But how do you think of your company data. Be part of our updated 2020 benchmark and take a quick Data Realities Survey – 3 questions only and you’ll see the results and how you compare by the end of March 2020.

By 2020, 30% of leading organizations will formally adopt infonomics practices and value their information assets, maintaining a balance sheet for internal purposes.

Gartner Group – by Douglas Laney, November 2018

It’s easy yet simplistic to think of data as a liability today. GDPR is a cost, extra work and to be frank – if you don’t have a data officer or steward – likely multiple people will have an extra task – with a perception of more work and no incremental benefit. Further, if you consider data breaches, and quite a few high-profile cases to mind, then not only is data expensive, it’s potentially damaging both reputation and money. Media is certainly attuned to this type of news.

Some companies even insure their data. Yet looking more closely at the Forbes article, it appears there is much hype around data breaches. It is imperative to protect data, and ensure its compliance with legal requirements. However, the context for breaches seem many times exaggerated, at best the opportunity to review current data compliance practices – and not just blame it on poor data security.

An article by Forbes in August 2019 state highly alarming figures – such as “4.1 billion records breached in the first six months of 2019”. They do offer context a bit lower in the article…” the majority of breaches reported this year had a moderate to low severity score”… And it is time to go back to basics in security awareness.

With the rise of data protection legislation, companies have been obligated to review their existing organizational data. While this is seen as additional work, there is strong logic that suggests that is also the right time to review data for potential value. In short – it is easy yet short-sighted to think about data as a liability.

Data can also be seen as the foundation for future cashflows.

What do we mean with this suggestion? Most assets depreciate over time. Is this true of data?

It is commonly understood that data, when latent and uncared for, has decreasing value over time. Data, when well cared for and maintained, can offer insights and benefit to a company. Does this also mean that data, as an asset, can appreciate in value?

Before answering the question, we do see some practices where certain assets appreciate over time.

Intellectual property can provide net present value on a balance sheet. Products and rich media services – songs, patents, video games to name a few – have associated revenues which are monetized over time. ‘Good will’ and “net present value of future potential revenue” are recognized by Wall Street. The current model of “sharing” and ‘experience’ instead of locked ownership has certainly been much more profitable for Spotify, Apple Arcade, Netflix and Sony’s Playstation Now vs the traditional model of a one time asset valuation.

Where else can we see this? In agriculture and livestock breeding, there are multiple stages of maturity and growth – where indeed physical items await full potential. This is true for various cattle as well as horticulture practices.

Spotlight – Agriculture and Livestock Farming as well as Intellectual Property

Livestock, especially steer, have a growth period, with an expected future return. As such, during the growth phase, they are worth relatively less, but show promising potential revenue. Plant bulbs, such as orchid, offer similar strategies. Intellectual Property also has net present value futures.

When enriched and curated, data has analogous principals to maturation. Over time, data can realize multiple benefits such as:

- Identifying client or customer prospect

- Increasing the value of prospects

- Providing deeper actionability of data (i.e attributes, scoring, algorithms)

- Operational insights

- Tactical transformation to Experience Economy Models

- Strategic decisioning

Looking forward, data can be nurtured to become a money maker. It can be shared, exploited and even monetized – offering insights that navigate businesses, supply chains and industries. Companies such as AC Nielsen, who were trail blazers, provide benchmarks and detailed information into industry supply and demand. Curated, pooled, enriched data, the core of such companies, offered and still provides value to many. This reality that future cashflows can be generated from data pools that you have freely available at your disposal.

In concluding, let’s look at the current state of the data union:

- There are no standard ways of stating ‘accounting’ valuing of data

- Unlike tangible assets, data value is not stable and can increase or decrease over time

- Wall Street values data at a high level, a distinct premium

- Business are being digitized, technology is cheaper, faster, exponentially improving

- Data generation and use is exploding

- Challenges in identifying fake versus real data, security and reliability become key

- Recognizing your data, ownership, correctness, freshness will be key in a competitive environment

- Data is a core asset and will become a main differentiator to businesses

Your organization is likely sitting upon untapped value. This is only the beginning of the data asset story. Stay tuned.

Want to learn more? Join us at our next MasterClass, we’ll announce dates soon – yet if you want to be pre-registered for the upcoming Amsterdam MasterClass @ Epicenter Amsterdam, just mail us at info@datatodollars.com

Thank you!

Rebecca Bucnis is the Managing Principal, Data To Dollars

Joan van Walbeek is Chief Pioneer & Principal, Exceptional Solutions, Data To Dollars.

Comments (3)